Pin Bar Forex Trading Strategy – Pin Bar Definition

An Introduction To The Pin Bar Forex Trading Strategy and How to Trade It Effectively…

An Introduction To The Pin Bar Forex Trading Strategy and How to Trade It Effectively…The pin bar formation is a price action reversal pattern that shows that a certain level or price point in the market was rejected. Once familiarized with the pin bar formation, it is apparent from looking at any price chart just how profitable this pattern can be. Let’s go over exactly what a pin bar formation is and how you can take advantage of the pin bar strategy in the context of varying market conditions.

What is a Pin Bar?

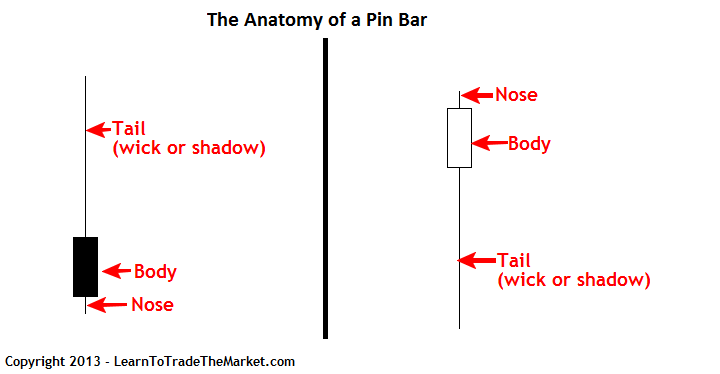

The actual pin bar itself is a bar with a long upper or lower “tail”, “wick” or “shadow” and a much smaller “body” or “real body”, you can find pin bars on any stripped-down, “naked” bar chart or candlestick chart. We use candlestick charts because they show the price action the clearest and are the most popular charts amongst professional traders. Many traders prefer the candlestick version over standard bar charts because it is generally regarded as a better visual representation of price action.

Characteristics of the Pin Bar Formation

• The pin bar should have a long upper or lower tail…the tail is also sometimes called the “wick” or the “shadow”…they all mean the same thing. It’s the “pointy” part of the pin bar that literally looks like a “tail” and that shows rejection or false break of a level.• The area between the open and close of the pin bar is called the “body” or “real body”. It is typically colored white or another light color when the close was higher than the open and black or another dark color when the close was lower than the open.

• The open and close of the pin bar should be very close together or equal (same price), the closer the better.

• The open and close of the pin bar are near one end of the bar, the closer to the end the better.

• The shadow or tail of the pin bar sticks out (protrudes) from the surrounding price bars, the longer the tail of the pin bar the better.

• A general “rule of thumb” is that you want to see the pin bar tail be two/thirds the total pin bar length or more and the rest of the pin bar should be one/third the total pin bar length or less.

• The end opposite the tail is sometimes referred to as the “nose”

Bullish Reversal Pin Bar Formation

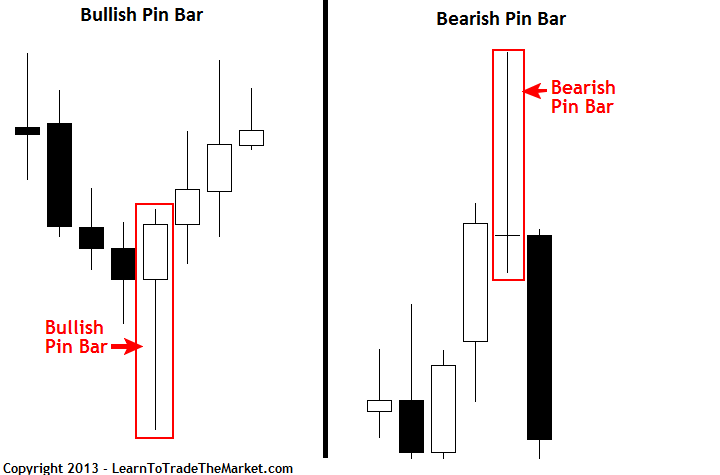

In a bullish pin bar reversal setup, the pin bar’s tail points down because it shows rejection of lower prices or a level of support. This setup very often leads to a rise in price.

Bearish Reversal Pin Bar Formation

In a bearish pin bar reversal setup, the pin bar’s tail points up because it shows rejection of higher prices or a level of resistance. This setup very often leads to a drop in price.

Examples of the Pin Bar Formation in Action

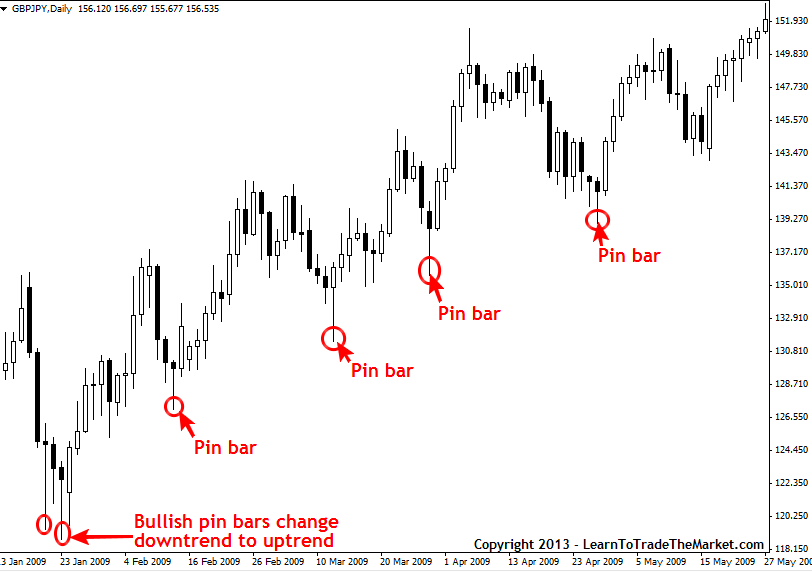

Here is a daily chart of CAD/JPY, we can see numerous pin bar formations that were very well defined and worked out very nicely. Note how all the pin bar’s tails clearly protruded from the surrounding price action, showing a defined “rejection” of lower prices. All of the pin bars below have something in common that we just discussed, can you guess what it is?

If you said that all the pin bars in the above chart are “bullish pin bar setups”, then you answered the question right. Good job!

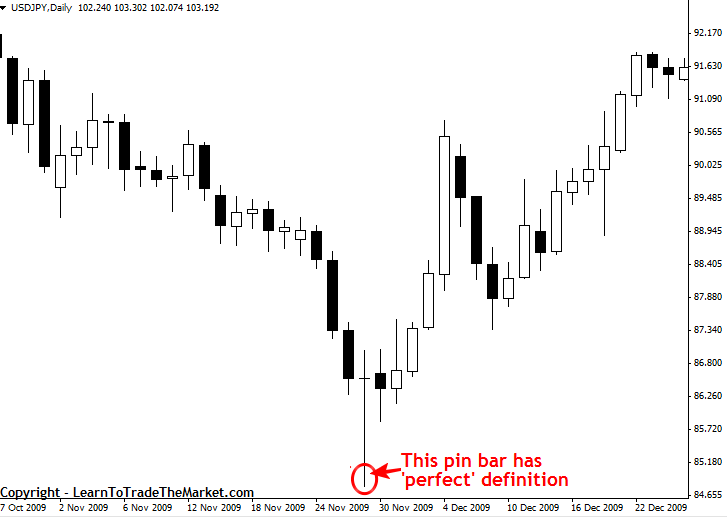

In the following daily USD/JPY chart we can see an ideal pin bar formation that resulted in a serious move and trend reversal. Sometimes pin bars like this form at significant market turning points and change the trend very quickly, like we see below. The example in the chart below is also sometimes called a “V bottom reversal”, because the reversal is so sharp it literally looks a V…

Here is an example of a trending market that formed numerous profitable pin bar setups. The following daily chart of GBP/JPY shows that pin bars taken with the dominant trend can be very accurate. Note the two pin bars on the far left of the chart that marked the start of the uptrend and then as the trend progressed we had numerous high-probability opportunities to buy into it from the bullish pin bars shown below that were in-line with the uptrend.

How to Trade a Pin Bar Formation

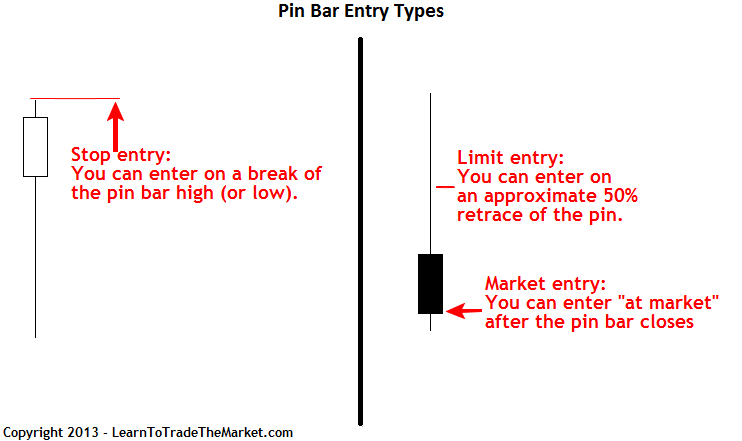

The pin bar formation is a reversal setup, and we have a few different entry possibilities for it:“At market entry” – This means you place a “market” order which gets filled immediately after you place it, at the best “market price”. A bullish pin would get a “buy market” order and a bearish pin a “sell market” order.

“On stop entry” – This means you place a stop entry at the level you want to enter the market. The market needs to move up into your buy stop or down into your sell stop to trigger it. It’s important to note that a sell stop order must be under the current market price, including the spread, and a buy stop order must be above the current market price, including the spread. If you need more help on these “jargon” words checkout my free beginners forex course for more. On a bullish pin bar formation, we will typically buy on a break of the high of the pin bar and set our stop loss 1 pip below the low of the tail of the pin bar. On a bearish pin bar formation, we will typically sell on a break of the low of the pin bar and place a stop loss 1 pip above the tail of the pin bar. There are other stop loss placements for my various setups taught in my advanced price action course.

“Limit entry” – This entry must be placed above the current market price for a sell and below the current market price for a buy. The basic idea is that some pin bars will retrace to around 50% of the tail, so we can look to enter there with a limit order. This provides a tight stop loss with our stop loss just above or below the pin bar high or low and a large potential risk reward on the trade as a result.

To effectively trade the pin bar formation you need to first make sure it is well-defined, (see pin bar characteristics listed at the top of this tutorial). Not all pin bar formations are created equal; it pays to only take the pin bar formations that meet the above characteristics.

Next, try to only take take pin bars that are displaying confluence with another factor. Generally, pin bars taken with the dominant daily chart trend are the most accurate. However, there are many profitable pin bars that often occur in range-bound markets or at major market turning points as well. Examples of “factors of confluence” include but are not limited to: strong support and resistance levels, Fibonacci 50% retracement levels, or moving averages.

Pin bar in range-bound market and at important market turning point (trend change):

In the chart example below, we can see a bearish pin bar sell signal that formed at a key level of resistance in the EURUSD. This was a good pin bar because it’s tail was clearly protruding up through the key resistance and from the surrounding price action, indicating that a strong rejection as well as false-break of an important resistance had taken place. Thus, there was a high probability of a move lower after that pin bar. Note the 50% limit sell entry that presented itself as the next bar retraced to about 50% of the pin bar’s length before the market fell significantly lower…

Pin bar in-line with trend with multiple factors of confluence:

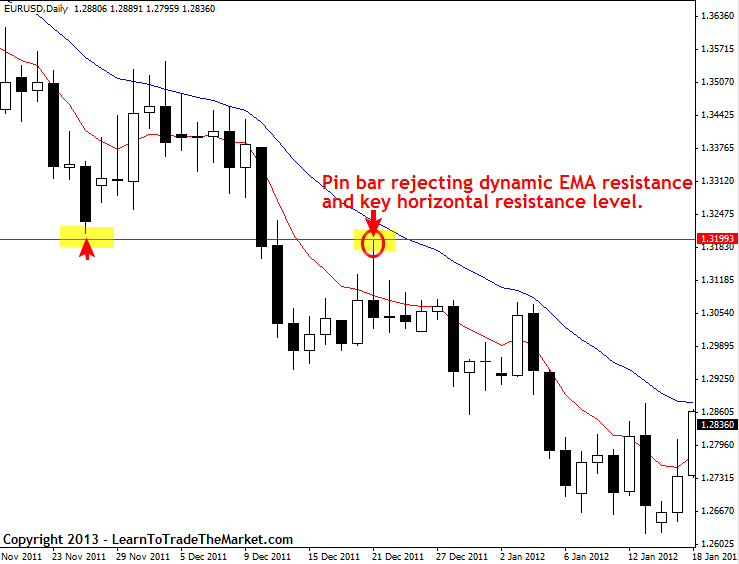

In the chart example below, we are looking at a bearish pin bar sell signal that formed in the context of a down-trending market and from a confluent area in the market. The confluence between the 8 / 21 dynamic EMA resistance layer, the horizontal resistance at 1.3200 and the downtrend, gave a lot of “weight” to the pin bar signal. When we get a well-defined pin bar like this, that has formed at a confluent area or level in the market like this, it’s a very high-probability setup…

Other names you might find pin bars described by:

There are several different names used in ‘classic’ Japanese candlestick patterns

that refer to what are basically all pin bars, the terminology is just a

little different. The following all qualify as pin bars and can be

traded as I’ve described above:• A bearish reversal or top reversal pin bar formation can be called a “long wicked inverted hammer”, “long wicked doji”, “long wicked gravestone”, or “shooting star”.

• A bullish reversal or bottom reversal pin bar formation can be called a “long wicked hammer”, “long wicked doji”, or “long wicked dragonfly”.

0 comments:

Post a Comment